What is traded in Forex? Currencies and Correlations

There is a large number of currencies we can trade. This can easily confuse newer traders. In

this lesson, we will look at currencies we can trade in the forex market and put them into

different categories. When we are trading forex, all currency pairs have the same structure. For

example, if we have EURUSD, the euro is called the base currency, and the dollar is the quote

currency.

For the currency pair USDJPY, USD is the base currency, and JPY is the quote currency. If we are

going to open the broker window with available instruments, we will see the names of currency

pairs and prices. For example, when we see EURUSD trading at 1.3, we will need 1.3 units of the

quote currency to buy 1 unit of the base currency. To simplify things, we need 1.3 US dollars to

buy 1 euro. Most of the world’s countries are using their own currency. But businesses are done

all around the world, so there is a high demand for a lot of these currencies. As we have many

currency pairs in the world, we separate forex pairs into three brackets

Majors, minors (also called crosses) and exotics.

Majors

Majors are the most traded and liquid currency pairs. All of them are paired with the US dollar

since the US dollar makes more than 80% of all trades in the forex market. So which currencies

are the majors? The most traded currency pair is EURUSD, nicknamed Fiber.

The Euro currency’s

nickname Fiber has the least known explanation. Still, many say that it comes from the fact that

the paper used for euro banknotes consists of pure cotton fiber, making it more durable and

giving it a unique feel. Next is the British pound, GBPUSD, also called the

Cable. The name

Cable comes from the fact that in the 19th century the exchange rate between

the US dollar and

the British pound was transmitted across the Atlantic by a large cable that ran across the ocean

floor between the two countries. AUDUSD, we call Aussie,

NZDUSD, is called Kiwi.

All these mentioned pairs start with foreign currency first and US dollar second. The last three

majors work the opposite; the US dollar is first and the foreign currency is second. We have the

Canadian dollar, USDCAD, which we call Loonie. The Loonie

refers to the one Canadian dollar coin

and derives its nickname from the picture of a solitary loon on the reverse side of the coin.

The others are USDCHF, called Swissy and

USDJPY, called Ninja. These seven currency pairs are

so-called majors. EURUSD is the most liquid and traded currency. In the second place, we have

USDJPY.

Minors/Crosses

These pairs are not quoted with US dollars but against each other. EURGBP, AUDJPY, NZDCHF and so

on. These pairs are usually less liquid but offer a great opportunity for traders who don’t want

to be exposed to the US dollar.

Exotics

Exotics include currencies from all over the world. We can find Polish zloty, Hungarian forint,

Hong Kong dollar, Swedish crown, Czech crown and many more. These are usually less liquid than

crosses and more suitable for longer-term positions than day trading.

Correlations

Some of the major currencies are tightly correlated with both indices and commodities. The

Canadian dollar is positively correlated with crude oil because Canada is a significant oil

producer and exporter. That means that an increase in oil prices usually means an increase in

the Canadian dollar value. Transfer this to trading forex trading, when oil prices go up, the

USDCAD goes down. Similarly, the Australian dollar and gold have a positive correlation because

Australia is a significant gold producer and exporter. Both gold and the Japanese yen are viewed

as safe havens in times of uncertainty, and these two are also positively correlated. Meanwhile,

gold and the US dollar typically have a negative correlation. When the US dollar starts to lose

its value amid rising inflation, investors seek alternative stores of value, such as gold. We

also should be mindful when trading majors itself.

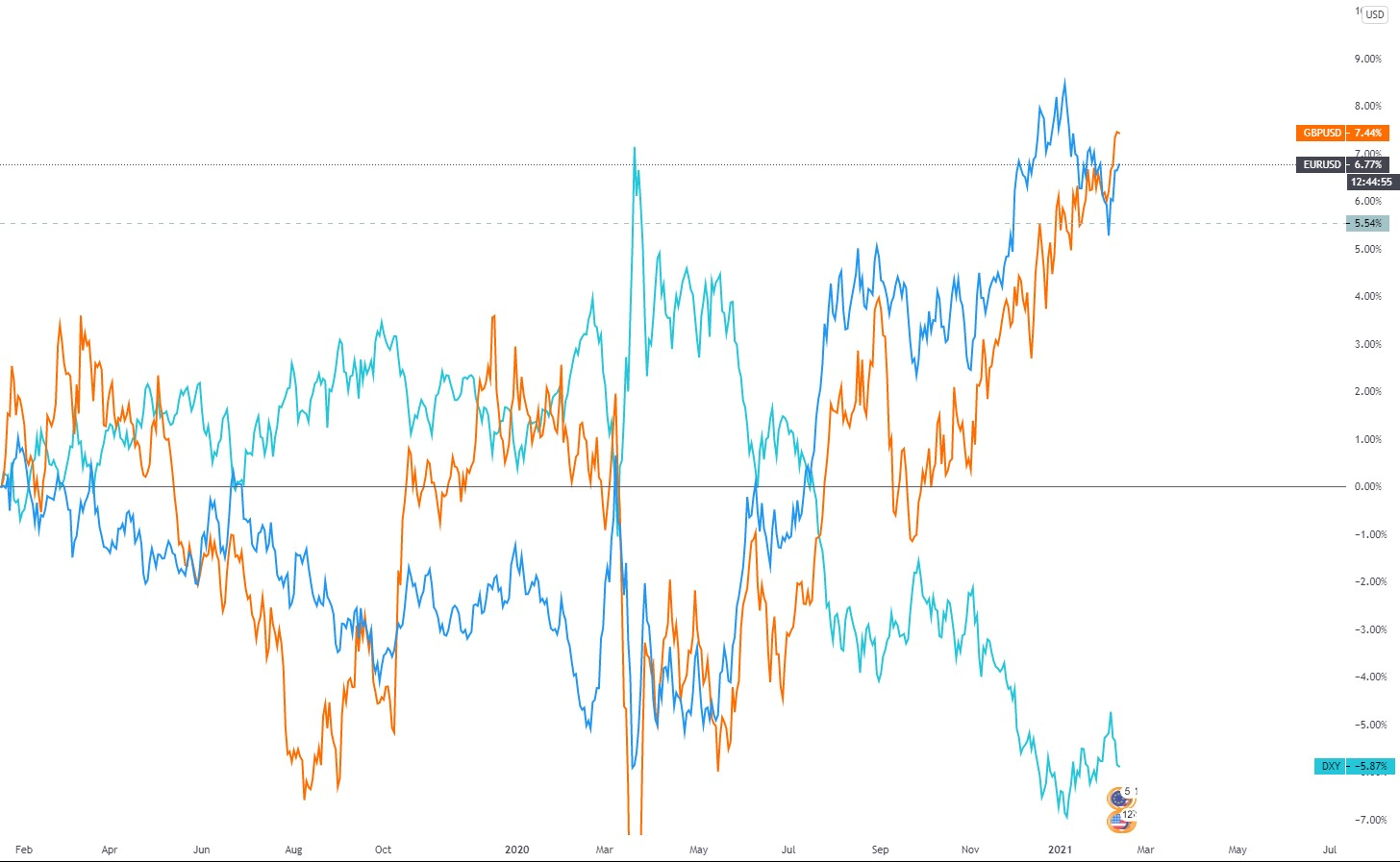

If we are going long on EURUSD and going long on GBPUSD as well, we are expressing the opinion

that the US dollar should weaken and those currencies strengthen. But if the US dollar gains

strength, both the euro and pound will most likely go down due to a strong inverse correlation

to the US dollar, which can be seen in the chart below. The blue line represents EURUSD, the

orange line GBPUSD, and the Dollar Index’s green line.

We should always pay attention to correlations because putting too much money on several tightly

correlated assets can result in more considerable losses than anticipated.

empty message

empty message

empty message

empty message

empty message